By Dr. Robert Hanner

Food fraud is not a new problem, but consumer awareness of the issue is increasing thanks to an endless barrage of media reports that expose new cases of fraud almost every day. The globalization of commerce has resulted in ever more complex supply chains that obfuscate transparency and undermine traceability, while also creating more opportunities for tampering. Brand reputation and consumer trust are at stake, not to mention potential liability issues that pose significant risks to the food and beverage industry. Companies cannot ignore these risks if they are to continue to thrive in this environment. Adaptation to change will require access to pertinent information resources and a willingness to implement new procedures and technologies.

The economic scope of the food fraud problem is estimated to cost the global food industry tens of billions of dollars annually and is provoking a variety of responses. Vulnerability assessments are advocated as a first line of defense among certification schemes and emerging regulatory policies, while blockchain is being heavily promoted to enhance the robustness of digital supply chain traceability systems. However, without verification testing, neither of these approaches can reach their full potential to mitigate food fraud.

Detecting fraudulent claims of ingredient identity, purity or country of origin demonstrates a breakdown in supply chain traceability systems and if you have a traceability problem, you have a potential food safety risk. A thriving food safety culture will be required for commercial success in the new food and beverage industry, which will require timely access to a variety of data flows. This applies to scanning a multitude of information resources on food safety and product recall alerts, as well as collecting verification data on one’s own supply chains.

Food authenticity and safety challenges are many and varied. Available data suggests risks are commodity specific. The geographic region of the supplier and processor is also relevant. Mitigating these risks requires up-to-date background information gleaned from import refusals and recall alerts. Transparent supply chain traceability systems coupled with appropriate verification testing at multiple points in the supply chain are also crucial. To this end, new technologies will play a key role in assessing vulnerabilities and mitigating risks. Portable DNA-based testing methods will be used to support authenticity claims and screen for biological contaminants. Advanced imaging technologies will enhance detection of foreign objects and other nonbiological contaminants, while stable isotope and trace element analysis will be used to authenticate country/geographic region of a product’s origin.

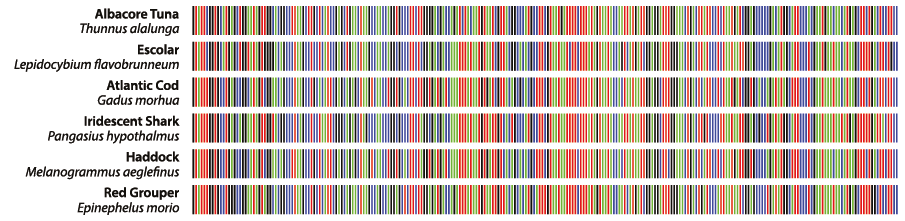

The role for DNA-based identification is worth watching closely given the power of the approach. For example, the University of Guelph is the birthplace of DNA barcoding, a method that relies on sequence variation in short, standardized gene sequences. This tool has been used to identify seafood fraud both in Canada and internationally. Notably, the Canadian Food Inspection Agency and the US Food and Drug Administration are both using barcoding as a regulatory tool to combat seafood fraud, while in April, the United Nations Food and Agricultural Organization issued a report calling on the World Trade Organization and Codex Alimentarius to establish an internationally accepted DNA-based framework to authenticate seafood and combat seafood fraud. Without such measures, Illegal Unregulated and Unreported (IUU) seafood harvest gets laundered into supply chains and threaten the sustainability of the world’s last remaining wild fish stocks.

Barcoding has also been used to reveal mislabelling in natural health products and other commodities, but it has its limitations in that it cannot be applied to highly processed products where the DNA is heavily degraded or to mixtures. This situation provokes a shift to using other DNA-based methods that rely on the use of species-specific molecular probes that can be applied to degraded materials and can be multiplexed to assess mixtures using quantitative Polymerase Chain Reaction (PCR) methods to detect DNA. Such tools have recently been applied to ground meat products to detect off-label meats adulterated into 20 per cent of sausages tested from across Canada. These tools are also commonly applied to detect food-borne pathogens, genetically modified organisms and allergens. They have the added value that new PCR platforms are emerging that can be deployed for use on site, a crucial consideration for incorporating DNA data into real-time business intelligence.

Massively parallelized next-generation sequencing platforms have the potential to simultaneously assess everything from food ingredients, adulterants, allergens, GMOs and pathogens, but they do not offer precise quantification. However, the emerging role for such tools in food forensics will only increase as platform research and development expands. For example, in research being conducted by the CFIA and others (including the University of Guelph) they are already playing a prominent role in the detection of plant viruses that threaten the sustainability of our food production systems.

For Canadian companies that want to utilize these new technologies, there are myriad opportunities. For example, the newly created Arrell Food Institute at the University of Guelph plays a key role in the knowledge transfer and translation of research results to the commercial sector as a key component of the University of Guelph’s Food from Thought initiative (supported by the Canada First Research Excellence Fund). Together with new spinout companies like TRU-ID, they seek to provide protection for Brand Canada. TRU-ID is the world’s first DNA-based certification program. It helps companies mitigate risk by verifying the authenticity of their supply chains while also providing brand differentiation through a consumer-facing logo that can be applied to products which subscribe to the certification program.

We all have a responsibility to provide safe and healthy products that sustain Canada’s reputation as a leader in the food and beverage sector. Consumer awareness, evolving legislation, globalization and technological innovation are changing the business landscape. However, unprecedented opportunities are also emerging, especially for those who are able to embrace change.

Canadian Food Business

Canadian Food Business