Evaluating the Importance of Food Labels

By Kathy Perrotta

With the Canadian government currently in the process of seeking feedback on new regulations for front-of-package nutrition symbols that would alert consumers to foods that are high in sodium, sugars or saturated fat, a review of current label evaluation behaviour reveals that there already is a whole lot of label reading going on.

Ipsos’ FIVE consumption tracking study, in place since 2013, reveals that an increasing number of adult Canadians (66%) report regularly reading product labelling detail. Of this group, the majority (72%) also state that the labelling detail on the package does in fact inform their buying choices.

Further evaluation confirms that consumers today are as likely to consult the Ingredient Label information to determine what is in the product as they are to read information contained in the Nutrition Facts Tables (NFT). This new behaviour demonstrates that consumers are still contemplating the nutrition of foods and beverages holistically and ultimately opting for the nutrients that are most important to them.

The increased contemplation of product make-up and ingredient content is driven by members of younger generations (ages 20 to 50). These consumers are also more likely to be motivated to choose products that are made with “pure and real foods” and “fewer and simpler ingredients”.

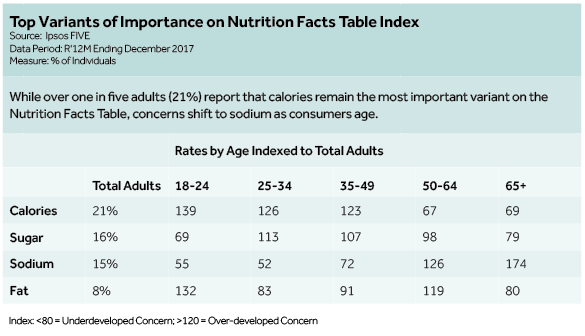

The most important attribute identified on the NFT remains calories, just narrowly edging out sugar (which has grown in importance in year over year tracking) followed by sodium, then fat. Not surprisingly, sodium content jumps up in primary importance to those consumers over 50 years of age.

The importance of food labels as a determinant of choice is further supported by the reporting rate of package label flashes as being important.

Topping the list of important variants to Canadians is Product Freshness (made on/sell by date labeling) followed by Product Source (country of origin, local), All Natural, High Fiber and No Artificial Flavours or Preservatives. Over the past two years, Organic and Good Source of Protein label flashes have also risen considerably in the influence of product choice.

Given that label reading is often associated with an increased focus on health-consciousness, perhaps consideration should also be given to evaluating cohorts of consumers that do not read labels to inform choices.

Consumers identified as Traditionalists who are focused on three square meals a day with lower snacking rates report less label reading (77 index to Label Readers (100)) as do Meal Skippers (76 index to Label Readers (100)). Quebeckers are also under-developed for label reading (77 index to Label Readers (100)) as are consumers living in rural areas (79 index to Label Readers (100)).

An evaluation of food and beverage behaviours and item choices among a variety of non-label reading cohorts compared to those that read labels shows some interesting nuances but, overall, choices are not all that different.

Anecdotally, increased access to available information to Ontario chain restaurant visitors legislated in January 2017 has made very little difference in influencing item choice. While three-quarters of visitors (76%) reported that they were aware of the posting of calorie information, the clear majority (84%) reported that the information did not influence their choice.

It has been more than 15 years since Health Canada introduced regulations surrounding food and beverage labels to assist Canadians with the quality of their choices.

Today, most Canadian adults are reading on-package information and are using this detail to inform their buying decisions. However, the question remains, will even more on-package information improve the healthfulness of food and beverage choices?

For example, would label symbols on the front of packaging that warned of high sodium, high sugar, and/or high saturated fat content influence consumers’ intent to read on-package information or even purchase? That is a question that Ipsos FIVE will address in the coming months.

FIVE is a daily diary tracking of what individuals ate and drank yesterday across all categories/brands, occasions and venues together with capturing attitudes, meal preparation habits, situational dynamics and general beliefs that influence choice. The FIVE study commenced in 2013 and tracks the behaviour of 20,000 individuals annually.

Canadian Food Business

Canadian Food Business