Rick Green*

The Canadian oilseed industry is an important economic driver for both our Agriculture and Agri-food sectors. Oilseeds are primarily grown for their oil content, which range in levels from 20% in the seeds of soybeans to greater than 40% for some canola and sunflower varieties; however other seed components, such as fibre, and protein by-products offer significant potential for both food, feed and industrial applications. The total oilseeds production in Canada in the 2011-2012 crop year was 22.4 million MT with canola dominating production (14.6 million MT) followed by soybeans (4.3 million MT), and flaxseed (0.4 million MT)1. Canada’s 13 crushing and refining/packaging plants have the capacity to crush about 8 million tonnes of canola seed, and in 2011-2012, produced 3.1 million tonnes of oil and 3.9 million tonnes of meal2,3. Further refining improves the colour, flavour and shelf life of canola oil. Canola oil is recognized by industry for its good stability during cooking and its nutritional attributes. A recent study the canola industry’s overall contribution to the Canadian economy was valued at greater than $19 billion2. The main Canadian oilseed products are oil for human consumption and meal for livestock feed. However, new oilseed crops are in development in Canada and are targeted at food, biofuel and industrial uses.

The Canadian oilseed industry is an important economic driver for both our Agriculture and Agri-food sectors. Oilseeds are primarily grown for their oil content, which range in levels from 20% in the seeds of soybeans to greater than 40% for some canola and sunflower varieties; however other seed components, such as fibre, and protein by-products offer significant potential for both food, feed and industrial applications. The total oilseeds production in Canada in the 2011-2012 crop year was 22.4 million MT with canola dominating production (14.6 million MT) followed by soybeans (4.3 million MT), and flaxseed (0.4 million MT)1. Canada’s 13 crushing and refining/packaging plants have the capacity to crush about 8 million tonnes of canola seed, and in 2011-2012, produced 3.1 million tonnes of oil and 3.9 million tonnes of meal2,3. Further refining improves the colour, flavour and shelf life of canola oil. Canola oil is recognized by industry for its good stability during cooking and its nutritional attributes. A recent study the canola industry’s overall contribution to the Canadian economy was valued at greater than $19 billion2. The main Canadian oilseed products are oil for human consumption and meal for livestock feed. However, new oilseed crops are in development in Canada and are targeted at food, biofuel and industrial uses.

Nutritional importance

Nutritional importance

Oilseed (i.e. vegetable) oils are comprised of fatty acids attached to a glycerol ‘backbone’ structure. These types of fatty acids determine whether a vegetable oil is used for edible or industrial purposes. Fatty acids are classified based on whether or not the fatty acid carbon chain contains no double bonds (saturated fatty acid, SFA), one double bond (monounsaturated fatty acid, MUFA) or more than one double bond (polyunsaturated fatty acid, PUFA). The PUFAs are further classified based on the position of the first double bond from the methyl terminal end of the fatty acid as n-6 (omega-6) or n-3 (omega-3) fatty acids. Humans are unable to synthesize n-6 or n-3 fatty acids, thus these fatty acids are essential dietary nutrients.

One of the major trends in the oilseed processing sector in Canada is optimizing the nutritional value of oils by increasing the n-3 (omega-3) fatty acid, particularly alpha-linolenic acid (ALA), content in oil and in our diet. There are three main types of n-3 fatty acids; ALA, docosahexaenoic acid (DHA) and eicosapentaenoic acid (EPA). ALA is an essential fatty acid and must be consumed in the diet. It can be converted into DHA and EPA although this conversion is very limited. Certain vegetable oils such as canola oil and flax oil are rich in ALA whereas some fish oils are rich sources of DHA and EPA. The major n-6 is oleic acid and this fatty acid is present in high amounts in canola oil, mid-oleic sunflower, high oleic soybean oil, and certain nut oils. The n-6 and the n-3 fatty acids are important in many aspects of health. The n-6 fatty acids are known to reduce low density lipoprotein and overall cholesterol and to help reduce the risk of cardiovascular disease and stroke, if consumed on a regular basis4. The n-3 fatty acids are of importance for reducing cardiovascular risk, in neurological function, and in inflammatory and immune disorders. The Association of Dieticians of Canada recommend that dietary fat for the adult population should provide 20% to 35% of energy and emphasize a reduction in saturated and trans-fatty acids as well as an increase in n-3 unsaturated fatty acids4. Furthermore, the Association recommends that n-6 fatty acids should comprise 3 – 10% of the energy intake and n-3 fatty acids should constitute 0.6 – 1.2% of the energy intake. The nutritional value of canola oil arises since it is low in saturated fats, and contains both the n-6 fatty acid, linoleic acid (LA) and n-3 ALA in a 2:1 ratio. In contrast, flaxseed and soybean oils have LA:ALA ratios of 1:4 and 8:1, respectively, whereas sunflower oil has primarily only LA present4.

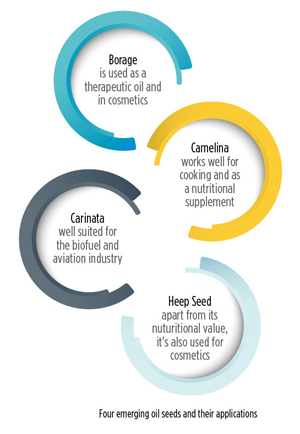

Emerging oilseed crops and their applications

Some emerging new oilseed crops have recently been receiving some attention. Borage was traditionally used for culinary purposes, however is now being produced as an oilseed rich in gamma linolenic acid (GLA), an n-6 fatty acid5. Borage oil is marketed as a GLA supplement although healthy adults are not typically deficient in this fatty acid. The oil is also used as a therapeutic oil and is formulated into cosmetics. Camelina (Camelina sativa) seed oil is suited for cooking and as a nutritional supplement in foods/functional foods. New varieties of camelina are in development for their potential to produce renewable oils for use in lubricants and polymers, providing an environmentally friendly alternative to petroleum products. The camelina plant can survive with little water and fertilizer on marginal land and is attractive to farmers as a rotation crop. Studies conducted by Agriculture and Agri-food Canada (AAFC) on the Prairies show that oil and protein content of camelina accessions ranged from 38 to 43 per cent and 27 to 32 per cent, respectively6. The fatty acids in camelina oil are primarily unsaturated, with only about 12 per cent being saturated. About 54 per cent of the fatty acids are polyunsaturated, primarily LA and ALA, and 34 per cent are monounsaturated6. Carinata (Brassica carinata) is another oilseed crop well suited for production in semi-arid areas, and can reach oil and protein levels of 44% and 28%, respectively7. The crop has an oil profile optimized for the biofuel industry and more specifically for applications in aviation biofuel production. Hemp seed contains 30 – 35% oil and represents a minor oilseed crop grown in Canada in terms of production. The oil contains 50 – 70% LA and 12 – 25% ALA, a ratio in the range of 3:1 of LA and ALA8. In addition to its nutritional value, hemp seed oil is of interest for use in cosmetics and therapeutics. Hemp seed is also valued for its protein content, ranging from 20 – 25%, 20 – 30% carbohydrates and 10 – 15% fibre8.

Adding value through fractionation and processing of other oilseed components

In addition to breeding efforts to produce designer oils with better nutritional properties, processing efforts focus on further refining and fractionation of fatty acids for blending purposes for specific applications. Oils can be modified by increasing the concentration of certain fatty acids such as n-3 fatty acids by techniques known as interesterification whereby fatty acids are redistributed on the triglyceride structure of the oil without altering the fatty acids themselves9. Other techniques involve selectively fractionating the oil based on its fatty acid composition. Fractionation techniques include fractionation based on the solubility in different solvents such as hexane or acetone (solvent fractionation9), melting points (known as dry fractionation9), the ability of unsaturated fatty acids to complex with urea and precipitate out of the oil (known as urea fractionation10) and by distilling off the fatty acids (or fatty acid methyl or ethyl esters) based on their volatility using a technique such as short path vacuum distillation11,12. Fractionation technology is being used to increase the ALA levels consumed through the incorporation of oil fractions whether as ingredients in our foods or as supplements in our diets.

Extraction of phytosterols (i.e. plant sterols) from the oils is also of significant importance, as they are known to lower the low density lipoprotein and overall cholesterol in the body, and have had scientific evidence showing benefits to lowering the risk of cardiovascular disease13. Phytosterols, once collected are either being used as ingredients in food products or for the supplement market in Canada.

The remaining meal left over after oil extraction is now being exploited beyond that of animal feed, for in particular its protein, and secondly its fibre for industrial material applications. The protein extracted from the meal also has market potential in the vegetable protein ingredient industry due to its excellent essential amino acid profile and functionality, provided damage from oilseed processing is minimized. The protein can also be hydrolyzed using chemical or enzymatic methods to produce peptides which may have unique applications such as reducing hypertension14.

Summary

Canada remains a global leader in oilseed production and processing of its seed oil. Strong growth in the sector is associated with increasing the value of nutritional oils and value-added fractionation of the oil and meal by-products for its components. In addition, there is increasing value in the development of new oilseed crops for bio-based fuels and industrial bio-products.

OILSEEDS IN CANADAHealth Production Processing Impact |

References

[1] AAFC (2013). Outlook for principal field crops. Agriculture and Agri-food Canada, Market and Industry Services Branch, March 19, 2013. Winnipeg, MB. Catalogue no. A77-1/2013-03-19E-PDF.

[2] Canola Council of Canada (2013). http://www.canolacouncil.org/crop-production/ca. Retrieved, October 11, 2013.

[3] Canadian Oilseed Processors Association (2012). A profile of the Canadian oilseed processing industry. Canadian Oilseed Processors Association. Winnipeg, MB.

[4] American Dietetic Association (2007). J. Am. Dietetic Assoc., 107, 1599

[5] Senanayake, S.P.J.N. and Shahidi, F. (2000). JAOCS, 77, 1: 55.

[6] Gugel, R K. & Falk, K.C. (2006). Can. J. Plant Sci., 86, 1047.

[7] Vakulabharanam, V. (2013). Carinata production in Saskatchewan. Agri-view, December 2012 – January 2013. Saskatchewan Agriculture, Regina, SK. 8, 5.

[8] Deferne, J.L. and Pate, D.W. (1996). J. Int. Hemp Assoc, 3, 1.

[9] Bokisch, M. (1993). Fats and Oils Handbook. Chpt. 6. Modification of Fats and Oils. American Oil Chemists Society, Champaign, IL.

[10] Hayes, D.G. et al. (1998). JAOCS, 75, 10, 1403.

[11] Cermak, S.C. and Isabell, T.A. (2002). Industrial Crops and Products, 15, 145.

[12] Shao, P. et al. (2009). Biosystems Engineering, 102, 285.

[13] Katan, M.B. et al. (2003). Mayo Clin Proc, 78, 965.

[14] Gu, Y. et al. (2011). Food Research International, 44, 2465.

* POS Bio-Sciences Corp., 118 Veterinary Road, Saskatoon, SK

(*Corresponding author: E-mail: rgreen@pos.ca)

Canadian Food Business

Canadian Food Business